Financing Your Purchase

The best place to start your property search is with a pre-approval.

When considering a property purchase, the first step is to contact a local lender to learn how much money you are eligible to borrow. There are a variety of financial institutions that fund mortgage loans, including banks, credit unions, and mortgage companies. Regardless of what type of institution you choose, you will be assigned a loan officer who will request some financial information from you, including an overview of your credit score. Your lender will use this information to determine the amount you are able to borrow. Once this process is completed, you will receive a pre-approval letter. This letter is a written commitment from the lender for a mortgage loan based on your financial qualifications.

It is highly recommended that you acquire this pre-approval letter before you begin your property search. Confirming what mortgage you can afford allows your real estate broker to search in the proper price range and gives them a better understanding of your specific needs. A pre-approval letter also means a higher offer acceptance rate; sellers are far more likely to accept an offer from a buyer who has been pre-approved. Overall, acquiring the letter first allows for a smooth process.

In some cases, a buyer’s credit report may reveal some negative information, like a high debt-to-income ratio or a low credit score. Discovering this information is part of the purchasing process as well, and your loan officer will use this information to tell you the steps you should take to improve the your financial qualifications. If it is not possible to get approved for any reason, your lender can offer guidance on what you can do in order to qualify for a mortgage loan in the future.

residential lenders

Landmark Professional Mortgage Company

Lender & President

NMLS# 116267

503-580-5647

cindy@landmarkprofessional.net

Guild Mortgage

Loan Officer

NMLS# 245049

503-589-1999

justinmorris@guildmortgage.net

Resident Lending Group

President & Senior Loan Officer

NMLS# 245049

503-589-1999

lois@residentlendinggroup.com

If you are interested in being on our vendor list please reach out. We would love to talk with you.

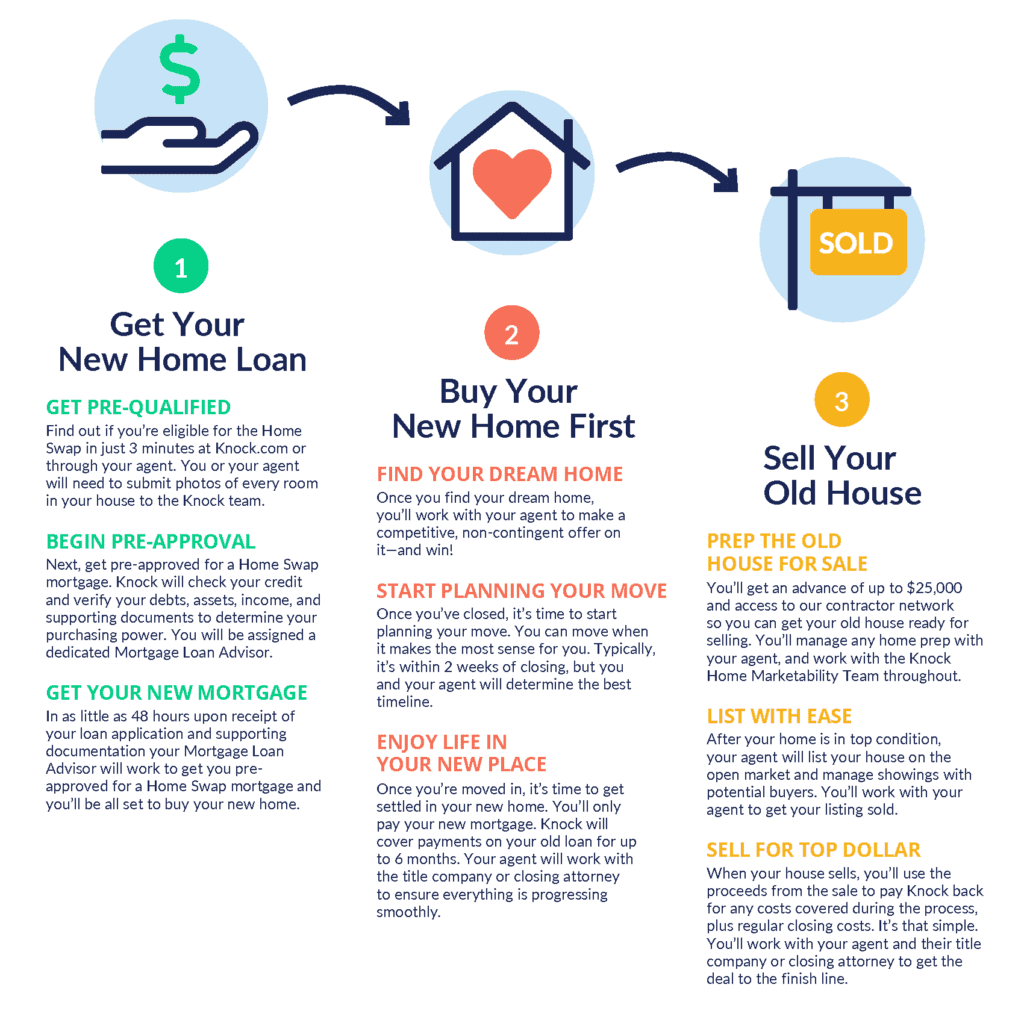

Knock Home Swap give you the certainty of buying the new home you want first and then selling your old one.

Contact us today to learn more about this program.

How does it work?